A new generation of over one billion digital native consumers are emerging in eight fast-growing countries in the next decade, creating new areas of growth for companies globally, found a new global commerce study by Accenture (NYSE: ACN).

Living in India, Bangladesh, Egypt, Ethiopia, Indonesia, Kenya, Nigeria, and the Philippines, these digital consumers are between the ages of 6 and 26 and represent 36 percent of the aforementioned countries’ population and their behaviours today offer key insights for companies looking to capture the next wave of commerce-driven growth.

According to Accenture Song’s report, this next generation of consumers presents a significant opportunity for global companies, particularly because digital commerce eases some of the traditional barriers to entry in these markets. Plus, the research also found that despite digital commerce revenues having quadrupled in these markets since 2017 — equating to $211 billion in 2022 – most multi-nationals are not set up to serve these digital-first consumers.

“The rapidly growing Indian digital commerce market provides huge untapped opportunities for growth and innovation for companies that move quickly and thoughtfully. Today, digitally native consumers expect a consistent and engaging shopping experience. However, our research shows that existing digital investments by companies are falling short of these expectations and trends show that most businesses may not be able to address them without a complete reinvention. To win consumers’ hearts, minds and wallets, companies need to develop deeply digital, fully harmonised cross-channel ecosystems for their brands. This will require data insights, technology and partnerships to power agile business models and commerce operations to remain relevant and resonant to the changing needs and aspirations of consumers,” said Vineet R Ahuja, Managing Director and Accenture Song Lead in India.

Who are the next generation of digital consumers

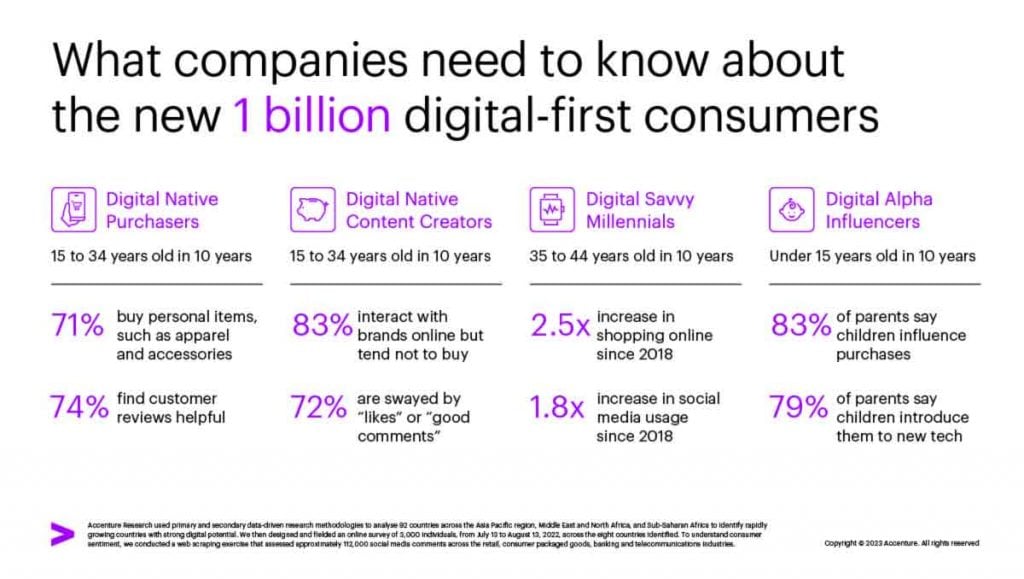

The report spotlights how the digital shopping behaviours of these emerging consumers have the potential to transcend boundaries and influence purchasing habits more broadly. Four core digital shopper archetypes were identified from 3,000 digital consumers surveyed across the eight countries including 500+ consumers in India. They are digital native purchasers, digitally savvy millennials, digital native content creators and digital alpha influencers.

Spanning three generations – Gen Alpha, Gen Z and Millennials – these four core segments of digital shoppers are already spending significant time online when discovering, considering and making a purchase.

The majority (79 percent) of surveyed consumers in India use online channels such as search engines, social networks and videos to research products or services before purchasing.

“Likes” and “good comments” on social media also influence 81 percent of these Indian consumers’ online buying decisions. More than half of emerging consumers in India prefer shopping on social media apps to other purchasing platforms.

At least six in 10 (63 percent) social commerce shoppers in India say they are more likely to buy from the same seller again.

Nearly 65 percent of consumers in India prefer to use online payment methods. They also say that convenient delivery options, such as “click and collect” (80 percent) and free delivery (83 percent), are critical drivers of their online purchase.

84 percent consumers in India see easy-return policies as a key influence on their online purchasing decisions.