Earlier this month, Disney CEO Bob Iger revealed that the traditional TV business was no longer viable for the entertainment giant, which is exploring alternatives. Reports also suggest that Disney intends to seek a way out of its Star business in India. These strategic shifts have put Disney’s India business in a challenging position.

Experts point out that intensifying competition is a major reason for the difficulties faced by media platforms in turning a profit. The best way for Star in the days ahead would be to land a merger deal.

“Everyone is fighting for a piece of the same pie. I strongly feel that like other sectors, there will be consolidation in this space as well and we should see a number of amalgamations amongst players. For Disney also, I see merger with an existing media player as the most plausible option,” says Rohit Jain, managing partner, at full service law firm, Singhania & Co.

The shift in consumer preferences towards digital streaming platforms and the rise of online content consumption have further disrupted the traditional TV business model. As a result, Disney’s India business, including the prominent Star network, is grappling with the need to adapt to new trends and consumer behaviour.

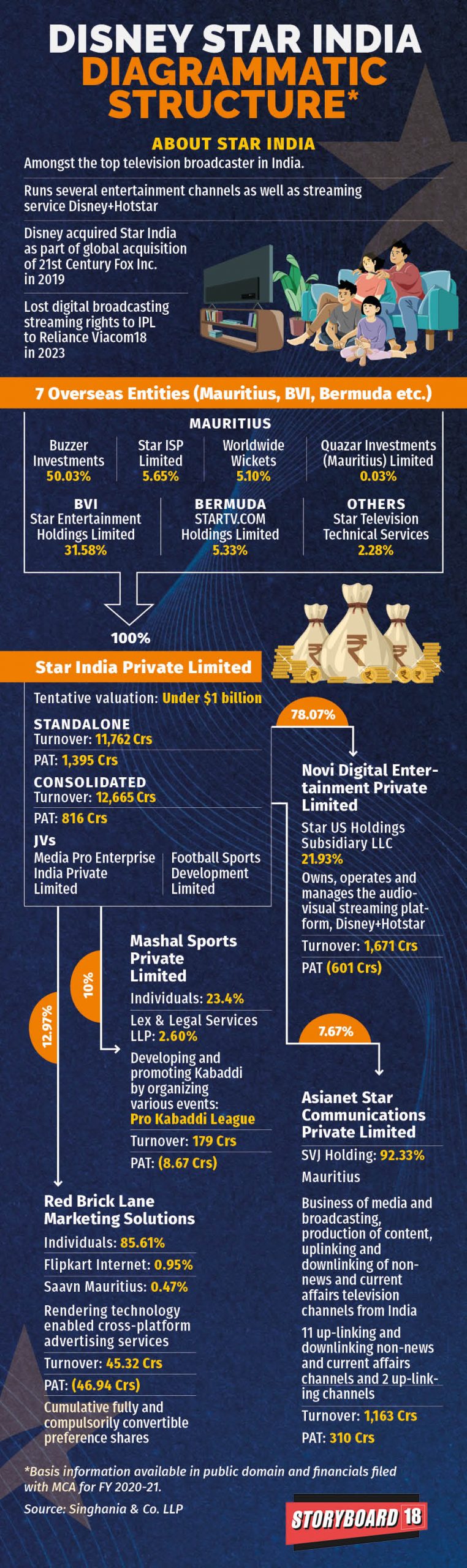

Disney’s third-quarter earnings report, set to be released on August 9, is highly anticipated because it is expected to provide insights into the company’s financial performance and its future strategies, but here’s what we already know. As per information available in the public domain and financials filed with the Ministry of Corporate Affairs, the tentative valuation of Star India Private Limited is under a billion USD, with a turnover of Rs 11,762 crore for for FY 2020-21.

The shareholders of Star India are 7 overseas entities located in Mauritius, the British Virgin Islands and Mauritius . These entities inter-alia include Buzzer Investments, Star ISP Limited, Worldwide Wickets, Quazar Investments (Mauritius) Limited, Star Entertainment Holdings Limited, STARTV.COM Holdings Limited and Star Television Technical Services.

Star India Private Limited owns 78.07 percent in Novi Digital Entertainment Private Limited, 12.9 percent in Red Brick Lane Marketing Solutions, 10 percent in Mashal Sports Private Limited and 7.67 percent in Asianet Star Communications Private Limited.

According to Kritika Seth, founding partner at another full-service law firm, Victoriam Legalis, the Companies Act, 2013, Competition Act, 2002 and Foreign Investment Regulations, will determine the legal framework of any merger or sale related developments for Star India.

After due diligence and all approvals, should Disney-Star look at a sale option, there could also be some potential roadblocks. “Some of the challenges include delays in obtaining necessary regulatory approvals. The sale of a company can have tax implications, including capital gains tax, stamp duty, and transfer pricing rules. Employment-related matters such as redundancies, severance packages, and compliance with labour laws need to be addressed appropriately,” Seth says.

“Existing contracts, licenses, and agreements need to be carefully reviewed to identify any restrictions on the transfer of rights or change in ownership. Additionally, ongoing or potential legal disputes involving the company could impact the sale process. Identifying and addressing these issues is crucial,” she added.

If and when a sale or a merger goes through, it will not be the first time the company will be witnessing a change in ownership. Change has been a constant for Star India ever since it started.

Established in 1990, Star TV started as a joint venture between Hutchison Whampoa and Li Ka-Shing. Channels like Star Plus, Star Chinese Channel, Prime Sports, Channel V, and BBC World Service Television were part of the initial line-up.

In 1992, Rupert Murdoch’s News Corporation acquired a majority stake of 63.6% for $525 million, followed by the complete buyout in 1993. Star India launched channels like Star Movies, Channel V, Star News, and later, Star Plus, catering to Indian viewers. This expansion solidified Star TV’s presence and brought diverse content options to the Indian audience.

Fast forward to 2019, and Star India underwent a transformative acquisition again. The Walt Disney Company acquired 21st Century Fox, which included Star India as one of its assets. This merger brought together two industry giants and expanded Disney’s footprint in the Indian market. This is also when Star India’s digital streaming platform Hotstar was rebranded as Disney+Hotstar.

The same Disney+ Hotstar, once considered a prized possession for all cricket enthusiasts also went through changes in terms of popularity. Disney+ Hotstar’s exclusive streaming rights to cricket content have been both a boon and a bane for Disney’s India business.

While it initially brought in a massive audience and subscription revenue, the loss of such popular content has had a significant impact on Disney+ Hotstar’s financial standing. The departure of the Indian Premier League (IPL) from the platform was a major blow, resulting in a decline in subscriptions.

However, the content drain did not stop there. Disney+ Hotstar also suffered the loss of all HBO offerings, which found a new home on JioCinema. This move resulted in the loss of a loyal audience who enjoyed acclaimed shows like Game of Thrones and Succession. The absence of these marquee titles further contributed to the challenges faced by Disney’s India business and affected the platform’s overall shine.

Read more: Is Star making up for loss in IPL through hiked ad rates in ICC World Cup?