By Sundeep Khanna

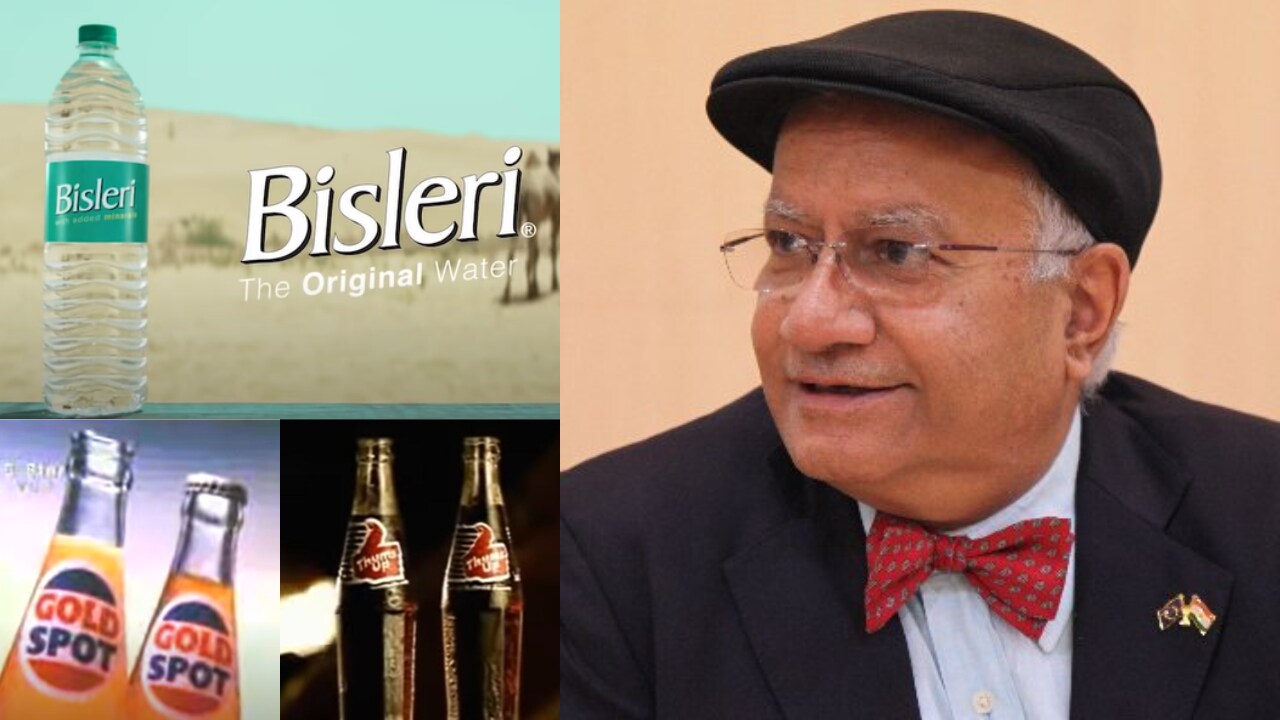

Between the $60 million sale of Thums Up to Coca-Cola in 1993 and the reported sale of Bisleri to Tata Consumer Products for Rs 7,000 crore ($857 million) lies the story of an entrepreneur who emerged as one of India’s canniest business leaders with an impeccable sense of timing.

While ill health might have been the immediate trigger, octogenarian Ramesh Chauhan must have also sensed that Bisleri’s future would be safer with a large Indian conglomerate like the Tatas.

Indeed, if an entrepreneur’s achievement is to be measured by the enduring value of the product or service that he creates, Chauhan bids fair to be counted among the best.

Thums Up, the take-off vehicle with which he announced his presence on the business stage, took off in the 1970s. Today, it is India’s biggest cola brand, ahead of those from global giants Coca-Cola and Pepsi.

Bisleri, which he turned his attention to next, has been even more spectacularly successful with a 60 percent share of India’s $2.5 billion market for bottled water.

Just how Chauhan built both brands is a case often celebrated by marketing textbooks. In 1977, Coca-Cola was chased out of India by the then Janata Party government, leaving behind a small, largely untapped market for carbonated soft drinks.

Chauhan, along with Campa Cola’s Charanjit Singh, saw an opportunity to fill the gap left behind by the multinational. Realising that India was changing and a new class of consumers, younger and better off, was taking shape, Chauhan targeted this emerging base of customers.

In doing so, he planted the seeds of one of India’s most recognisable consumer brands which, by the time economic liberalisation set in, was already a leader with an 80 percent share of the $350 million soft drinks market. When Coca-Cola returned to India, it found its competition wouldn’t be its global rival Pepsi, but an entirely local brand.

Chauhan, who by his own admission isn’t excited by “making money for the sake of making money” but by the “roadmap to developing a brand and fighting to take over a market,” wasn’t just a one-trick pony.

By the mid-1990s, he was already on to his next big idea. Packaged water wasn’t yet a thing in India but the MIT-trained engineer sensed that as more Indians took to travel, they would want safe and hygienic water in disposable packs.

From the family’s stable of products, he now picked out one that had been launched by his father Jayantilal Chauhan, and made it his new flagship product. Soon, driven by Chauhan’s strategic vision, it was a clear market maker and leader.

So, what do you do once you have fathered two such mega brands? Chauhan’s answer has been to sell them off.

Which brings us to the other feature that marks him out as an entrepreneurial genius – timing. Many Indian entrepreneurs have known when to enter a new business segment. The likes of Vijay Mallya, Naresh Goyal and Rana Kapoor were smart enough to recognise the latent potential of a newly opened market segment.

Yet, as their sorry fate affirms, what they didn’t know was when to exit. Indeed, most entrepreneurs get married to their businesses and stay on till death do them part. Sadly, in many cases it’s been the death of the business itself.

Chauhan, however, thinks differently. Which is why he sold Thums Up when it was at its peak to Coca-Cola. The $60 million he got sounds like a steal for the cola giant, given that it acquired billion-dollar brands Thums Up and Limca in the bargain.

But Chauhan had calculated what it would cost to retain share in a fiercely competitive market dominated by two MNCs with deep pockets. So he collected his winnings and left.

In the intervening 25 years, Coca-Cola and Pepsi have gone on to corner the cola market between them but at great cost. Profits for both have been scarce in the course of the bruising battle for market share.

The same principles probably apply to the sale of Bisleri, which the Chauhans acquired over 50 years ago for the princely sum of Rs 4 lakh. In the past 20 years, Bisleri has lorded over the vast and growing market for packaged water despite the presence of global brands including Coca-Cola’s Kinley, Pepsi’s Aquafina and Nestle’s Pure Life, besides dozens of local brands.

But Chauhan is 82 and reports indicate his only daughter Jayanti may not be keen to keep running the business. Against that background, the octogenarian business leader has taken the tough but practical decision to sell the family jewels when there is a keen buyer for it.

As Kenny Rogers sang:

“You’ve got to know when to hold ’em,Know when to fold ’em,Know when to walk away,And know when to run.”

(This story first appeared in Moneycontrol)