Between January and June 2023, a total of 51,000 advertisers with 67,000 brands exclusively advertised in print.

Author: Tasmayee Laha Roy

SEBI bars Goenka and Chandra from key managerial roles in Zee companies, sets 8-month timeline for probe completion

It would be appropriate for Goenka to not be a part of the management of ZEEL or any corporate avatar of it, the order said.

Supreme Court to introduce stronger self-regulation guidelines for television channels

The Supreme Court finds the existing guidelines to be not effective enough

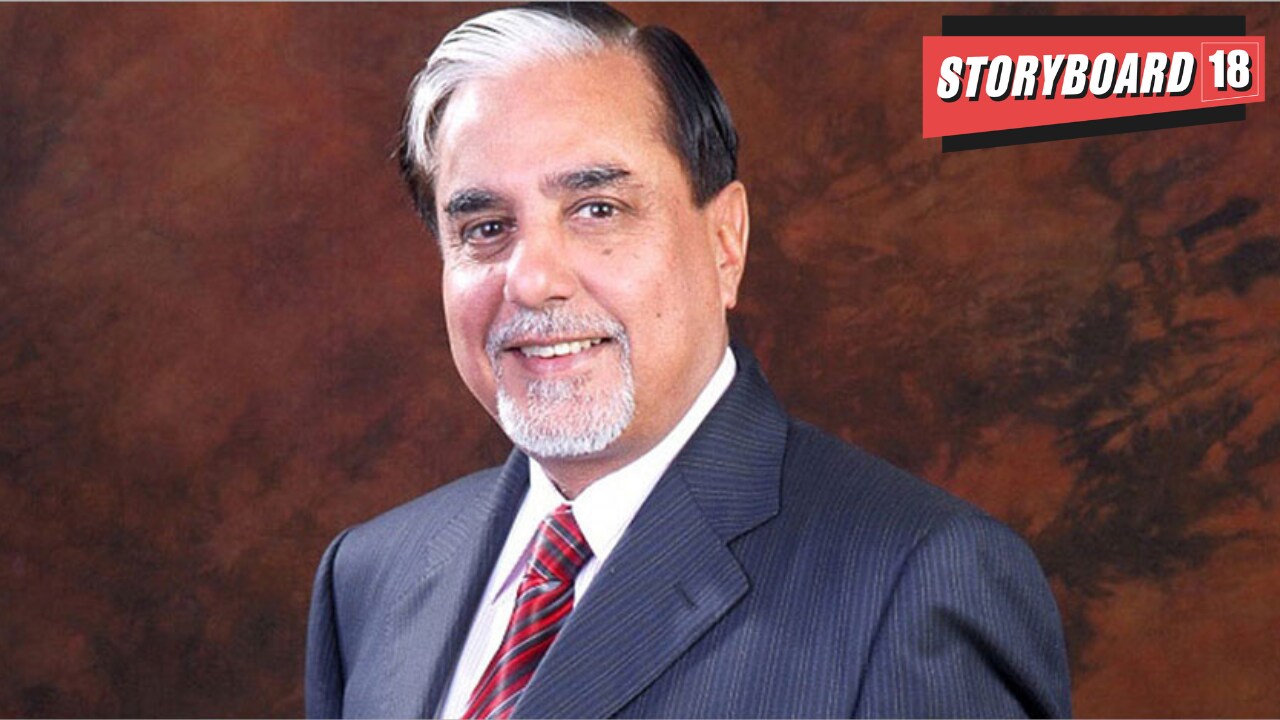

Essel Group’s founder Subhash Chandra navigates Rs 6,500 Crore debt settlement with JC Flowers ARC

Discussions for the repayment were underway for months now and it took close to a month for both parties to come to a settlement.

BARC expands audience measurement system, adds 25,000 panel homes in 2022

The system is reportedly all set to add another 20000 odd homes to the panel in the next three years.

Rajya Sabha passes the Press and Registration of Periodicals Bill, 2023

New Bill introduces registration for periodicals, empowers press registrar general and sets penalties for non-compliance.

Explained: What are the GST Council’s tax recommendations for online gaming?

The 51st GST Council meeting on August 2 approved 28% GST on online gaming on full face value, clearing doubts and confusion surrounding the matter.

GST Council clears the way for taxing offshore gaming companies; experts divided on its impact

The council recommended inserting a specific provision in the IGST Act, 2017, to provide for liability to pay GST on the supply of online money gaming by a supplier located outside India.

GST Council decision on online gaming: Industry voices concerns and hopes for future review

While re-strategising business models might be an option for the larger players, for the smaller online gaming enterprises, the weight of taxation could prove to be insurmountable as per stakeholders.

Digital Personal Data Protection bill, 2023: DPB can advise government to take down content or block access

The unexpected inclusion of content takedown powers has raised concerns among experts, particularly regarding its potential impact on internet and social media platforms.