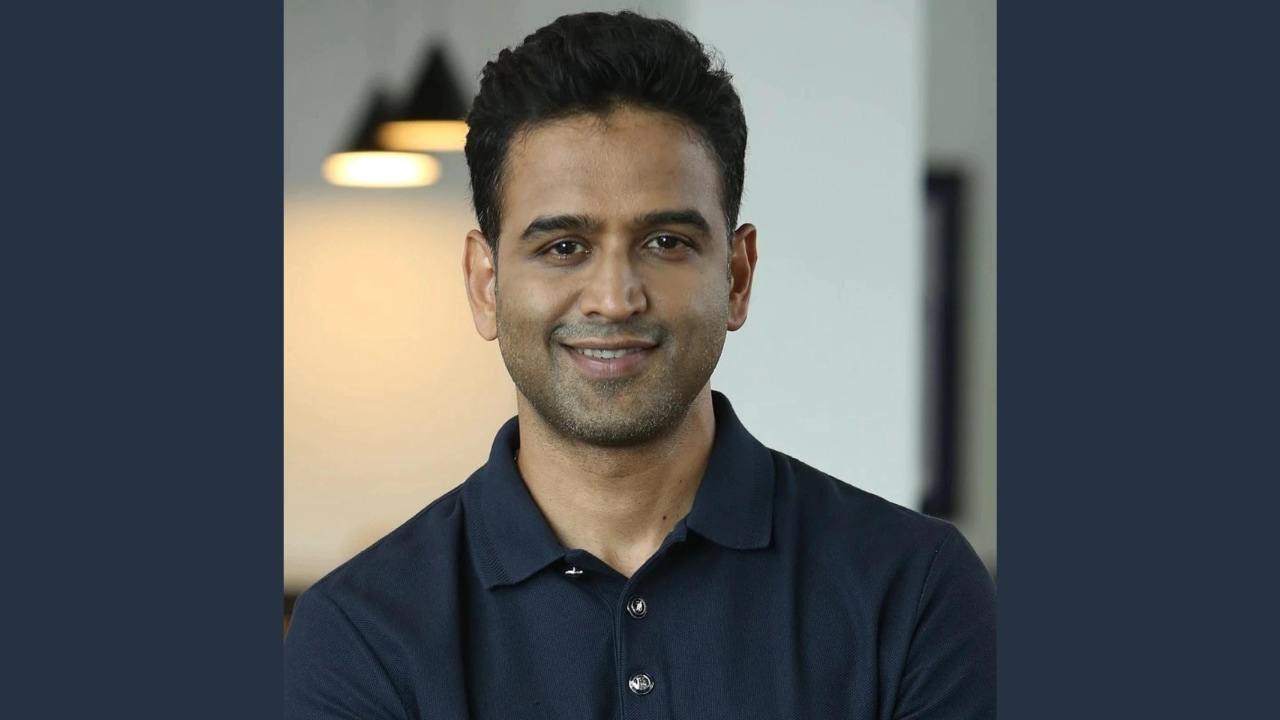

Zerodha co-founder and CEO Nithin Kamath on Monday weighed in on reports of Mercedes India sales and marketing head Santosh Iyer’s claims that the rising popularity of SIPs (Systematic Investment Plans) in India is affecting sales of the luxury car.

Taking to Twitter, the billionaire investor wrote, “A saving mindset is what will help us in times like now when countries that have borrowed heavily are getting screwed? In a world of rising interest rates, this will probably get much worse before it gets better for them.”

A saving mindset is what will help us in times like now when countries that have borrowed heavily are getting screwed? In a world of rising interest rates, this will probably get much worse before it gets better for them. 1/2 pic.twitter.com/PhpEu7onS0

— Nithin Kamath (@Nithin0dha) November 28, 2022

This was in response to Iyer’s statement to Times of India where he claimed that if the money saved for SIP was diverted toward the luxury car market, the business would improve tremendously.

“There is a savings mindset in India because social security measures here are much fewer,” the Mercedes India top executive told the publication. “There is a tendency to save not only for yourself, but also for your kids. This is unlike the West, where you save for yourself to the maximum extent… The Rs 50,000 that a potential customer invests into a SIP if diverted towards the luxury car market, will see business explode.”

Reacting to this, Nithin Kamath added in a different tweet, “Isn’t slow and steady growth much better (like compounding in investing) than debt-fuelled explosive growth where people borrow to buy depreciating assets?

Neither good for customers nor for businesses in the long run.”