The gaming businesses are only beginning to see layoffs and shutdowns. There will be more, say experts.

Tag: gaming

IQOO appoints Shwetank Pandey as chief gaming officer

In addition to the chief gaming officer role, iQOO has also appointed two zonal CGOs to the dynamic team. Aojesh Shrivastava from Delhi and Battu Nikhil Reddy (Shoutout YT), Hyderabad.

Online gaming platforms face Rs 45,000-crore tax demand

The Directorate General of GST Intelligence (DGGI) is likely to issue notices to these companies soon.

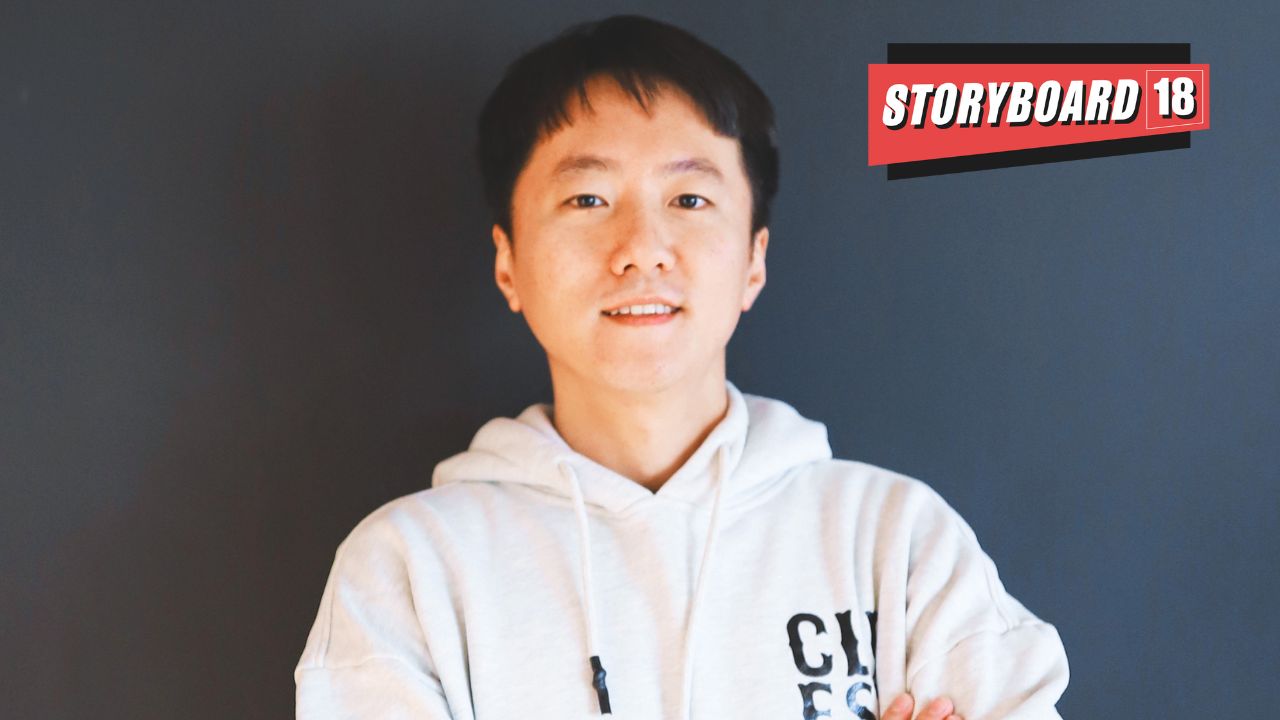

Gaming major Krafton looking for deep-tech Indian firms for localised content

“We believe in the power of Indian content and the potential of Indian IPs” says Krafton India’s CEO Sean Hyunil Sohn.

Krafton to invest $150 million in Indian startup ecosystem in next 2-3 years

Beyond game development studios, Krafton’s investments span across complementary sectors, including, Esports, multimedia entertainment, content creation and audio platforms.

28% GST impact: Mobile Premier League lays off 350 employees

The announcement of higher tax rates for online gaming had the industry anticipating a significant financial burden. This move has already led to layoffs, starting with MPL.

Explained: What are the GST Council’s tax recommendations for online gaming?

The 51st GST Council meeting on August 2 approved 28% GST on online gaming on full face value, clearing doubts and confusion surrounding the matter.

GST Council clears the way for taxing offshore gaming companies; experts divided on its impact

The council recommended inserting a specific provision in the IGST Act, 2017, to provide for liability to pay GST on the supply of online money gaming by a supplier located outside India.

GST Council decision on online gaming: Industry voices concerns and hopes for future review

While re-strategising business models might be an option for the larger players, for the smaller online gaming enterprises, the weight of taxation could prove to be insurmountable as per stakeholders.

MSMEs will no longer be able to survive in the face of the increased tax liability of 400-500 percent: AIGF

E-Gaming Federation (EGF) and FIFS (Federation of Indian Fantasy Sports) said the burdensome increase in GST will set the Indian online gaming industry back several years.