Singapore-based creator tech company Animeta, in its report highlights the limited access brands have in the country.

Tag: influencer marketing

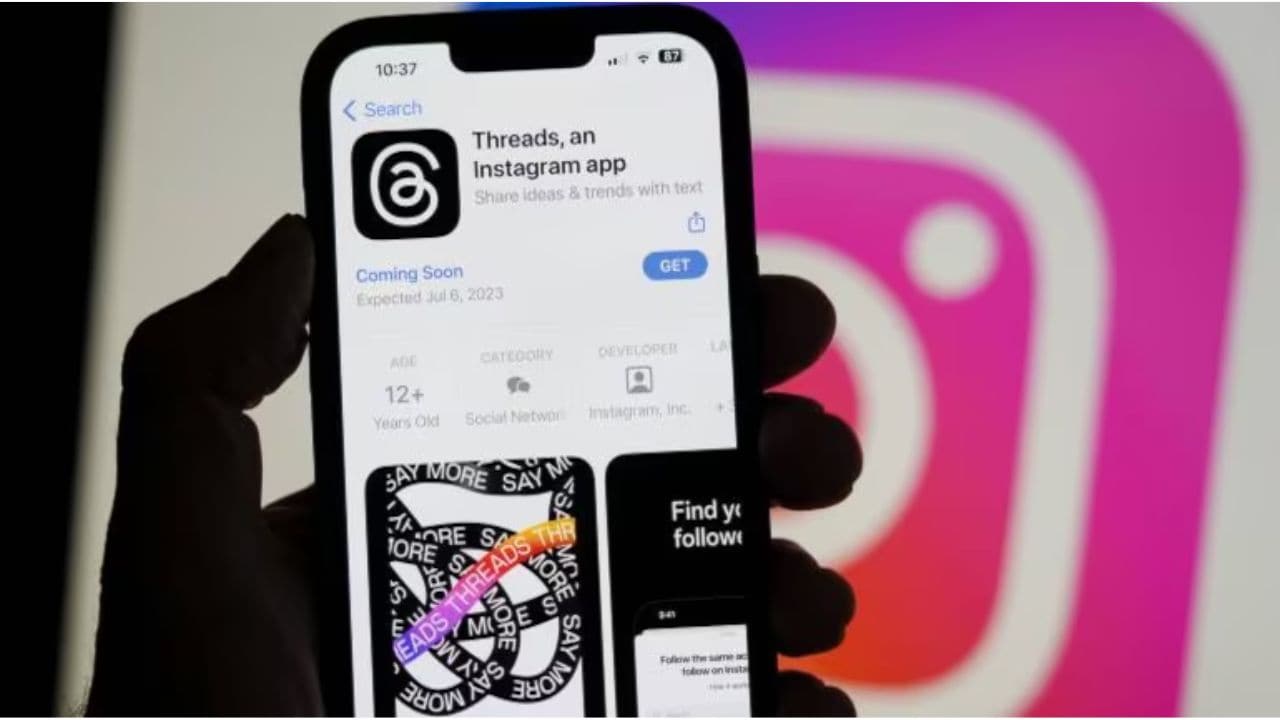

Ashish Chanchlani becomes India’s top influencer on Meta’s Threads: Report

CarryMinati and Triggered Insaan follow next on the list.

Vishal Dhupar NVIDIA’s MD – Asia South on AI disrupting advertising, WPP deal and more

NVIDIA’s MD – Asia South Vishal Dhupar talks to Storyboard18 about the impact and effectiveness of AI on industries including advertising and marketing.

Zerodha’s CEO and co-founder Nithin Kamath on financial literacy and why finfluencers need regulation.

Finfluencers are new-age personal finance consultants who create digital content on social media. Their genre is one of the fastest-growing content universes online. Recently, there has been a universal call for tighter regulations for finfluencers who have taken over the internet.

Why are creators and marketing agencies liking Threads more than Twitter?

Longer-form writing, Instagram’s vast user base, and none of Twitter’s incessant negativity. Creators and influencer marketing agencies are Liking Threads over Twitter. For now.

Weekly Shorts: Affiliate influencer marketing – the cost-effective solution

Under affiliate influencer marketing, you compensate creators based on the sales made by the affiliate links — unique links or discount codes — included in the content.

Customers don’t need influencers to tell them about chemicals in food, says iD Fresh founder Musthafa PC

Responding to the recent food influencer videos that called out bigger food companies, Musthafa PC says that consumers should not rely solely on influencers to make better food choices.

Finfluencers should educate not advise says Zerodha’s co-founder Nikhil Kamath

Finfluencers should educate people because financial literacy is the need of the hour but if they start giving financial advice then that needs to be regulated, says Nithin Kamath, co-founder and CEO of Zerodha.

Finfluencers need to be regulated urgently: Zerodha’s Nithin Kamath

The CEO and co-founder of the largest brokerage in the country shared how ambiguity around rules need to be addressed too.

Influencers’ influence waning? GenZ listen to friends over social media influencers

Gen Z consumers are 50 percent more likely to take their friends’ recommendation over an influencer or a celebrity while making a purchase decision, revealed a study from Yuvaa.